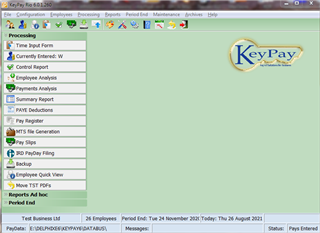

Welcome to KeyPay

- Details

Payroll Software for Business

KeyPay was developed in New Zealand primarily for SMEs (small medium enterprises) employing staff in New Zealand, although, it has in numerous cases more than adequately met the needs of much larger payrolls, with several hundred employees. Simplicity, ease of use and compliance of New Zealand regulations have been at the forefront of any considerations in it's development. This, backed up with our desire to provide our clients with a superior level of service and support, has been our driving force since we first entered this industry in 1985.

KeyPay software has provided practical payroll solutions to employers of 1 to several hundred staff. Client organisations which have utilised KeyPay software represent a wide range of industry and commerce, including manufacturing, retail, marketing, construction, telecommunications, tourism, hospitality, leisure, sport, health, agriculture and horticulture.

KeyPay is easily configured and customised to suit the individual needs of each client company. Whilst KeyPay is full of features and options, these can be selectively switched on or off making only those relevant to each client organisation visible to the user. This makes it simple and very fast to process each pay without any compromise in flexibility. With our latest Ver 6 many employees can be paid with just 2 keystrokes.

KeyPay is developed to strictly meet NZ taxation and NZ Holidays Act requirements. While the Act is complicated, we believe that KeyPay is as compliant as possible, given that some areas are subject to interpretation and the decisions made by humans who sometimes make the occasional mistake. We are determined that KeyPay should always minimise these with warnings and confirmation. Considerable effort went into its design to ensure it does the right thing with regard to the law. For example, average leave rates are continuously updated, with the greater of it and ordinary rate always available and applied to leave payments.

KeyPay Version 6.3.4

- Details

Version 6.3.4

Fixes some recently discover bugs and adds some new features.

View KeyPay 6 latest build changes

Expect next version to include Kiwi Saver changes to support 3.5% from April 2026

Windows 10 support ending

- Details

The Windows 11 TPM Scam...

Microsoft requires computers to support TPM 2 to install windows 11 and claims its vital for security and is prepared to sentence some 400 million PC's to death. This is unconscionable!

There is no reason that Microsoft cannot support computers with earlier TPM versions that most PC's do support. In fact, many owners purchased their current computer only a few years ago. Some manufactures only fitted TPM 2 to their computers around 2023, and as such should remain O.S supported for 10 years. (Microsoft policy is to provide support for 10 years.) They should therefore continue support for Windows 10 for up to another 5 years. (If you purchased a PC since 2020 and it doesn't have TPM2, Microsoft should support it until 2030 with Windows 10 or provide a Windows 11 upgrade.)

Experts have advised that TPM 1 is still sufficiently secure and the enhancements that TPM 2 offers are not essential for security at present. Microsoft could easily allow computers with TPM 1 onto Windows 11 with no less security, perhaps with warnings, than currently available on Windows 10.

Why then are they being so stubborn? TMP 2 allows Microsoft to have much greater control of your PC by embedding boot keys that they own, forcing the creation of a Microsoft account, and among other things can prevent installing a different system and has been seen to remove any dual boot operating systems.

For full details read article by Stacy Higgenbothem to Microsoft on these issues. (Link to PDF available on the site below.)

Good News (for some)

Some owners have discovered that their non windows 11 compatible computers have a software version of TPM and that it can be upgraded to TPM 2 with a simple BIOS update from the manufacturer. Perhaps ask Chat-GPT if your motherboard or model can support TPM 2.

IR Updates April 2025 to March 2026

- Details

Changes from April 2025

A.C.C Earners Levy

Levy increased to $1.67

Student Loans

No Changes - threshold remains at 464 pw or $24128 / no yearly pays.

KiwiSaver

ESCT / RSCT earning threshold for rates below 39% increased. (To reflect the higher Aug 2024 thresholds)

Tax Changes

Extra Pay: Tax on Grossed up amount calculated from the last four weeks can use last two pay period paid earnings instead.

This allows for irregular pay periods and for monthly employees two pays are combined instead of one.

Fringe benefit tax changes.

PAYE Calculator

- Details

Tax Calculator 4.26

New version for Tax year from August 2024 to March 2026 now available for free under Downloads Calculators.

This version includes the latest changes from 1st April 2025 to March 2026.

Version 4 adds scaling for YTD earnings to the Year period.

RansomWare

- Details

Ransomware in 2025

Still the biggest internet threat to users and continues to increase every year with clicking links to fake websites the main source of infection.

Recent reports are showing a preference for targeting larger businesses and organisations rather than individual users, probably because they are easier to manage and owners place a much higher value on their data so the rewards are much greater. Also the cost of downtime and effort to recover from backup can be more than just paying up for a quick fix.

The current trend is to not just encrypt ones data, but to download it and threaten to publish the information for anyone to view.

A major incident in 2025 was the Australian Airline Qantas where hackers accessed 6 million client accounts and obtained names, email addresses and phone numbers.

A worrying development is that non programmers have been using Chat GP to develop code for this and other malware purposes. While any use of Chat GP for illegal use is prohibited, and mostly blocked, there are ways around this.

It has been estimated that victims of ransomware paid over 1 Billion US dollars in 2016 to recover their data and in future it's expected to be much greater. Are you prepared?

Checkout our page about it and how to avoid becoming a victim and if the worst happens to recover without paying up!